It really wouldn’t be an understatement to say that the financial services sector faces many challenges, particularly over the last few years and notwithstanding the constraints of the recent global pandemic, which have only served to escalate issues such as how to improve procedures around ID verification, how to increase the security of documents, how to ensure the legitimacy of contracts, how to provide proof of transactions, and how to avoid the challenge of ‘abandoned baskets’—in other words, unsigned and forgotten agreements.

This is all in addition to the increasing spotlight and scrutiny that the financial services industry is under, in what is becoming a more pressurised economic environment. Those working within businesses under the financial services umbrella are always on the lookout for ways in which they can improve procedures and aid their day-to-day operations whilst continuing to operate within the strict financial regulations laid down by their governing bodies.

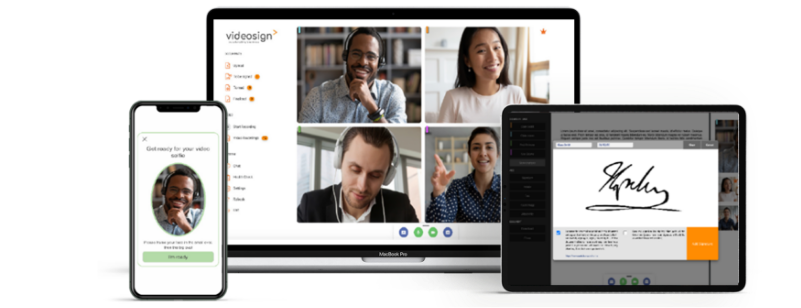

All these issues cause those working in the financial services industry unnecessary stress and headaches—and that’s where Videosign can help. We support the industry with a range of robust digital tools that provide an easy way to verify identities, enable the signing of documents, and allow the witnessing of electronic signatures remotely in a safe and secure platform.

With many features and benefits, Videosign truly benefits professionals working within the financial industry by speeding up traditionally time- and labour-intensive processes. Videosign’s advantages include:

Meet with clients face-to-face remotely – the Videosign platform incorporates a secure online meeting space, speeding up the process of liaising with clients and enabling meetings to take place regardless of distance. Additionally, this tool provides increased accessibility so that clients can review, sign, and witness documents compliantly. Ultimately, this can enhance the customer journey and result in a better all-round experience for them—and for you.

Easy to access – as Videosign is a browser-based tool, meeting attendees only need access to the internet to join a meeting via a URL link. There is no requirement to download any software, which limits the chance of error and ensures participants can join meetings successfully.

Verify identities – with Videosign you can easily perform and complete identity and verification checks in a matter of seconds while meeting your clients face-to-face in the secure online meeting space. Enhanced facial recognition and biometrics are used, removing any doubt as to who is signing your document. This ensures futureproof validity and provides you with a robust audit trail.

Validate digital signatures with embedded certificates, recordings, and audits – with Videosign, all meetings are automatically recorded as standard. These are classed as evidence and can be used in court if required. Certificates can be generated from within the software, or users have the option to upload their own.

Finalise documents – by meeting clients face-to-face with Videosign, you have the tools at hand to offer a purely digital experience, from video conferencing to remote signing and witnessing of documentation. This ultimately eliminates lengthy delays in the return of signed contracts and documents by walking your clients through them whilst you are still in the online meeting room.

The Videosign platform is not limited to one specific area of financial services—it has been and can be utilised effectively across many of the industry’s sub-sectors, from accounting to fund management.

The list of how Videosign can be used across the financial services industry is not exhaustive, but here are just a few examples:

Accounting

Accountants and bookkeepers use Videosign to support their clients with assistance with their accounts, provide reviews and financial assessments, as well as budgeting and forecasting advice and general consulting for new and established businesses.

“Videosign has proved to be an invaluable tool in our business; it’s sped up discussions with clients and has reduced administrative tasks already.”

Wealth Management

Used by some of the best-known names in the industry when discussing services such as life assurance and pensions, Videosign offers wealth managers a secure and accessible meeting space—allowing them to identify their clients, perform database lookups (such as AML checks), meet face-to-face, and digitally sign documents.

“Utilising Videosign has reduced the need for separate digital tools for meetings and electronic signing, and so has limited the possibility of IT issues.”

Personal and Retail Banking

Customers in the banking sector are becoming increasingly comfortable using live video platforms to conduct their business. Typically, 80–90% of consumers use their laptops, phones, and tablets for banking, and therefore remote meetings and sign-offs are the next logical step. It is no longer necessary to ask customers to visit the bank to sign documents or for bank personnel to witness signatures in person. With Videosign, banks can now offer a superior and safer user experience for their customers.

“An excellent platform for supporting our customer service offering.”

Commercial Banking

Businesses can securely and easily meet with their customer relationship manager at their corporate banking facility to discuss, instruct, and agree on elements of their banking requirements—for example, payment processing, merchant services, commercial loans, global trade, and treasury services.

“The list of ways we can utilise Videosign within our business continues to grow—from external meetings with clients to internal team meetings.”

Insurance

Whether you are selling insurance products or managing claims, Videosign gives you a secure and compliant meeting space to discuss, advise on, and agree on insurance documentation quickly.

“An easy-to-use tool.”

Funds & Investments

Advisers specialising in the management of funds and investments require a safe and secure platform to discuss and agree on the highly confidential subjects of shares, assets, bonds, and market information with their clients. Videosign provides the answer.

“Very impressed with this all-in-one ID verification, video conferencing, and e-signing tool.”

For more information, or if you have questions about the Videosign e-signing platform, contact our team to arrange a call or schedule a quick demonstration.