During the pandemic lockdowns, businesses had to adapt to working remotely, and even as restrictions are lifting many are continuing with these online remote-first practices.

A challenge financial institutes have with meeting online is how to verify identities accurately. A critical step is needed to ensure there are no potentially fraudulent issues, to ensure that potential clients are who they say they are and that there are no credit issues recorded. This can often be delayed or made complicated by cross-department handling or require more than one software application causing ruptures in the client journey and slowing down deal conversion.

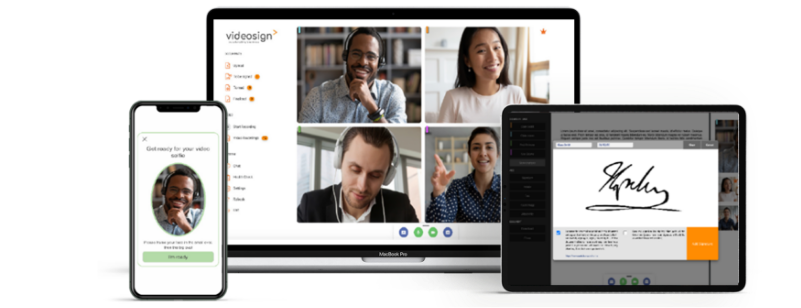

The Videosign verification feature simplifies this process in one process allowing you to:

- conduct background checks

- ensure their credit rating is OK

- enable you to verify your customers’ identities

- meet and sign unlimited documents

The process is concluded simply and securely in one remote business enablement platform using our leading-edge biometric identity verification system. By using facial mapping and AI you can compare identification documents and a selfie returns compliant results in seconds, protecting your business and customers from identity theft fraud.

To find out more, or to request a demo, contact us at enquiries@videosign.co